does tennessee have inheritance tax

However there are additional tax returns that heirs and survivors must resolve for their deceased family members. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

Tennessee Taxes Do Residents Pay Income Tax H R Block

The inheritance tax is levied on an estate when a person passes away.

. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. The Federal inheritance tax exemption for 2014 was raised to 534000000 today.

But as pointed out by the other posters the amount excluded from the federal tax is 55 million 11 million if married so this wont affect the OP. All inheritance are exempt in the State of Tennessee. Inheritance tax usually applies if the decedent lived in one of those six states or if the property being passed on is.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Tennessee Inheritance and Gift Tax. It has no inheritance tax nor does it have a gift tax.

Technically Tennessee residents dont have to pay the inheritance tax. However it applies only to the estate physically located and transferred within the state between Tennessee residents. Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Tennessee is an inheritance tax-free state. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95.

All inheritance are exempt in the State of Tennessee. Its paid by the estate and not the heirs although it could reduce the value of their inheritance. Inheritance Tax in Tennessee.

The Tennessee Department of Revenue has two forms one for estates that are less than 1 million and one for estates that are greater than 1 million. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. The executor will determine which form is necessary and go from there.

There are NO Tennessee Inheritance Tax. Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. What is the inheritance tax rate in Tennessee.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. IT-15 - Inheritance Tax Exemption for. Next year it will increase to 500000000 and then it will be abolished in 2016.

I know TN has no state income tax. The inheritance tax is different from the estate tax. However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end.

All inheritance are exempt in the State of Tennessee. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. The inheritance tax applies to money and assets after distribution to a persons heirs.

IT-15 - Inheritance Tax Exemption for. It is possible though for Tennessee residence to be subject to an inheritance tax in another state. Even though this is good news its not really that surprising.

Inheritance tax is collected when a beneficiary inherits money property or other assets after someone dies. There are NO Tennessee Inheritance Tax. Texas repealing its own inheritance tax has no effect the federal inheritance tax.

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. An estate tax is a tax on the value of the decedents property. Even if it did the estate would be responsible for paying the tax not the inheritor.

Tennessee does not have an inheritance tax either. It is one of 38 states with no estate tax. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. What Other Taxes Must be Paid.

Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now. What Other Taxes Must be Paid. So if i make 100k in capital gains is there a capital gains tax on this in Tennessee.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. According to the Tennessee Department of Revenue Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death The TN Department of Revenue goes on to explain. Tennessee does not have an estate tax.

It means that even if you are a Tennessee resident but have an estate in Kentucky your heirs will be. Do Tennessee residents have to worry about an inheritance tax. For example if a Tennessee resident receives in Heritance from someone who died in Pennsylvania they can.

Only seven states impose and inheritance tax. If you pass away in Tennessee with an estate less than 1 million there is no inheritance tax. For the purposes of this post we are going to address the last question about Tennessees inheritance tax.

Tennessee and Federal Estate Tax Exemptions Raised Today for 2014. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. There is no federal inheritance tax and only six states levy the tax.

An inheritance tax is a tax on the property you receive from the decedent. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Tennessee does not have an inheritance tax either.

The District of Columbia moved in the. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Not sure if theres some.

For example the neighboring state of Kentucky does have an inheritance tax.

Tennessee Retirement Tax Friendliness Smartasset

Tennessee Health Legal And End Of Life Resources Everplans

Tennessee Retirement Tax Friendliness Smartasset

Tennessee Arts Commission Cool Cat

Tennessee Estate Tax Everything You Need To Know Smartasset

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Tax Comparison Florida Verses Tennessee

Tennessee Inheritance Laws What You Should Know Smartasset

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Estate Tax Everything You Need To Know Smartasset

Probate Fees In Tennessee Updated 2021 Trust Will

2013 2022 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

What You Need To Know About Tennessee Will Laws Probate Advance

Divorce Laws In Tennessee 2022 Guide Survive Divorce

Tennessee State Economic Profile Rich States Poor States

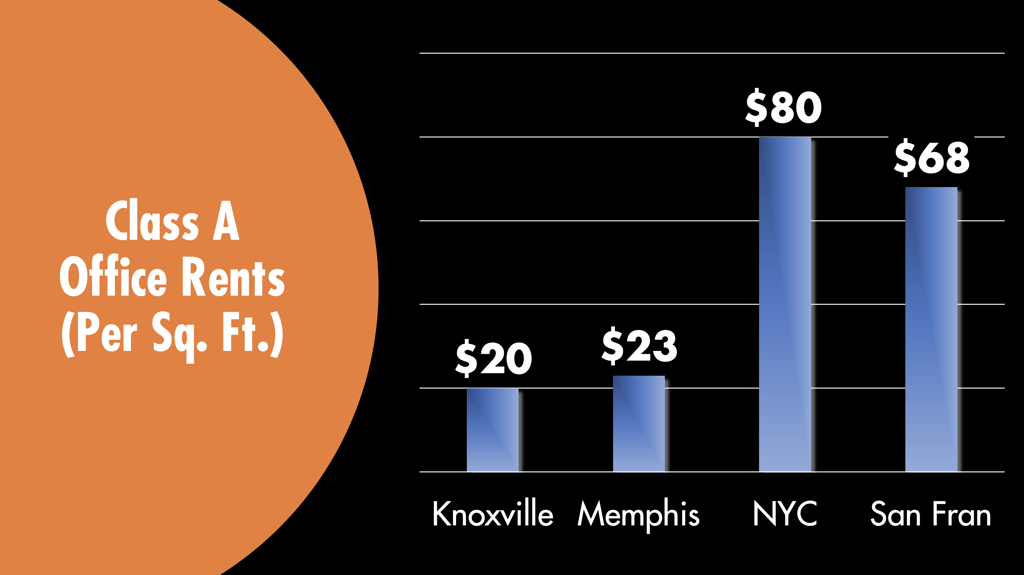

The Pros And Cons Of Locating Your Business In Tennessee

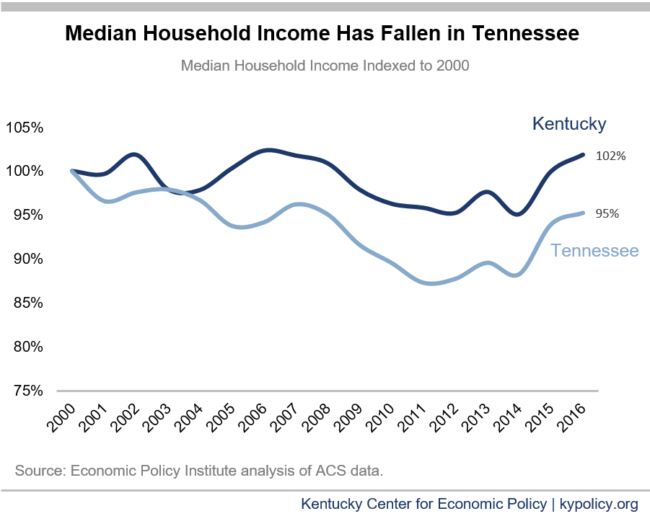

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Historical Tennessee Tax Policy Information Ballotpedia

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament